Understand Your Finances, Build your Future.

Gain personalized insights, compare your finances to country and age-based statistics, and get smart, actionable steps to improve your financial well-being.

Crunching numbers...Crunching numbers.

Simplify your Personal Finances

Get a clear snapshot of your finances with our AI-powered analysis. Understand your money, effortlessly.

Pocket Score

Your 3-Step Financial Assessment

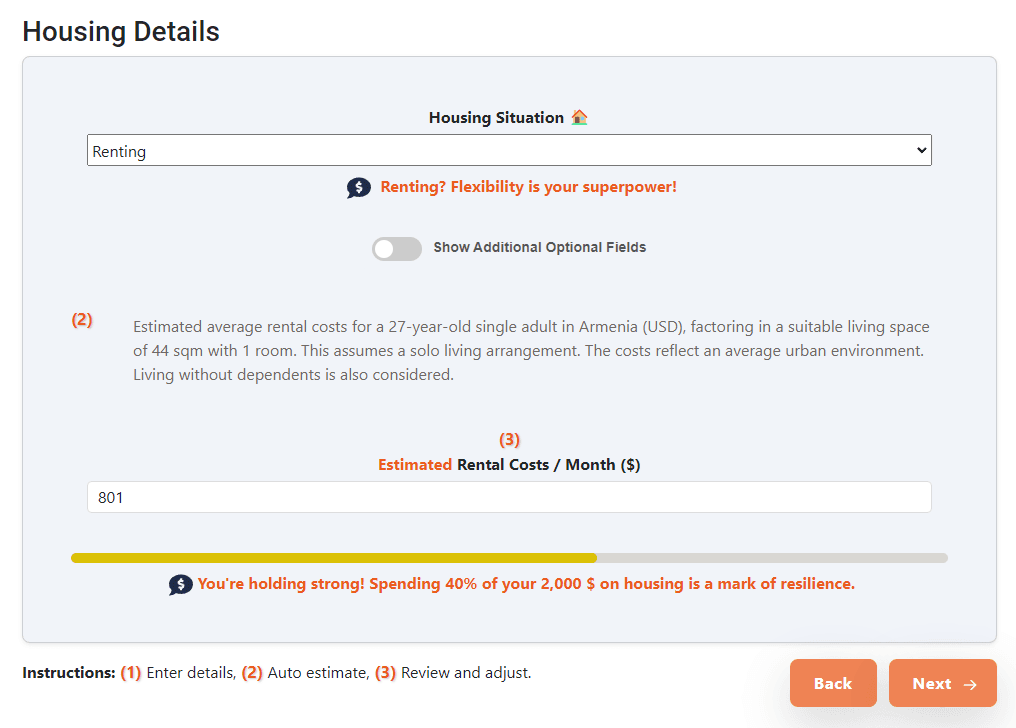

Step 1. Easy Guided Form

- Effortless: Let AI predict and auto-fill costs for you. Review and adjust with ease.

- Comprehensive: Covers income, debt, costs, lifestyle, and savings.

- Insightful: Get real-time feedback and benchmarks.

Step 2. See Your Finances

Unlock your personalized dashboard.

- Costs Overview: Analyze your expenses and spending patterns effortlessly.

- Net Worth Forecast: Track your assets, liabilities, and financial trajectory.

- Interactive Visuals: Sankey Flow Charts and Waterfall Diagrams for clear insights.

Step 3. Financial Health Score

- Comprehensive Evaluation: Detailed Personal Finance Health Score analyzing income, costs, savings, and investments.

- Breakdown by Buckets: Understand each financial area, identify opportunities for improvement, and celebrate your strengths.

- Actionable Insights: Receive tailored recommendations and practical plans to enhance your financial well-being.

FAQ

Got more questions? Feel free to send us an email to hello@pocketnumbers.com

At PocketNumbers, our mission is to empower individuals worldwide with clear, actionable, and personalized financial insights in the simplest way possible. We aim to make personal finance management accessible to everyone, regardless of their financial knowledge, by combining cutting-edge technology, data-driven analysis, and user-friendly design.

Our primary goal is to help users take control of their personal finances through Pocket Score, the most comprehensive end-to-end personal finance tool available. This feature guides users step-by-step through an interactive and AI-assisted form, leveraging smart autofills, contextual benchmarks (like income comparisons in their country), and tailored feedback. Once completed, users unlock a detailed and visually rich dashboard, offering:

- A comprehensive breakdown of their financial health, from income and cost management to budgeting and beyond.

- A personalized financial health score with actionable insights to pinpoint strengths and areas for improvement.

- Data-driven recommendations and an actionable plan designed to align with their unique lifestyle, situation, and goals.

In addition to Pocket Score, PocketNumbers also offers tools like the Income Livability Calculator and Benchmarks. These features evaluate how well an individual's income aligns with the cost of living in their country based on age and life circumstances. Users can compare their financial health against global standards in developed nations or explore how their income stacks up across different countries and job roles.

At its core, PocketNumbers is driven by a commitment to helping users make informed financial decisions with confidence, using a data-based, personalized approach that adapts to their unique conditions. Our vision is to become the world's go-to platform for simple, insightful, and actionable personal finance guidance.

PocketNumbers offers a free version with valuable personal finance analysis. We are committed to providing a high-quality and insightful experience tailored to real people. We also offer premium features for users who want to take their financial planning to the next level.

The financial health scores provide a snapshot of the status of your personal finances by taking into account factors such as income, expenses, savings, investments, debt management, personal conditions such as country, age or dependants, lifestyle. A higher score typically indicates a stronger financial position, stronger personal finances management and more financial freedom. On the other hand, lower scores indicate tighter financial margins, which can result in less disposable income after covering essential living expenses.

The score is ultimately presented as a percentage (0-100%) and can be interpreted as follows:

- 95%+ (A+): Exceptional

- 90-94% (A): Excellent

- 80-89% (B): Great

- 70-79% (C): Good

- 60-69% (D): Okay

- 50-59% (E): Poor

- Below 50% (F): Very Poor

We only require a few key details to get started, such as your age, country, and income. These essential inputs are enough to generate a personalized and meaningful financial analysis tailored to your circumstances.

To further enhance the precision of your analysis, you have the option to provide additional data points. This is entirely optional, and the decision to share more information is completely up to you.

We are committed to respecting your privacy and ensuring that you remain in full control of your information throughout your experience with our platform.

Your privacy and data security are of the utmost importance to us. All the information you provide is safeguarded using industry-leading encryption standards both in transit and at rest, along with strict confidentiality protocols.

We do not sell, rent, or share your personal data with any third parties. Your information is used exclusively to deliver personalized financial insights and analysis tailored to your needs.

You retain full control over your data at all times. Should you wish to delete your information from our system, you can do so easily by contacting us at privacy@pocketnumbers.com. We will promptly process your request and confirm the removal of your data.

Our commitment to privacy, transparency, and user trust is foundational to everything we do. We strive to provide a secure and reliable platform that you can confidently use to manage and enhance your financial well-being.

For more information, please review our Privacy Policy.